The recipe for attractive BTM storage: location, location, location

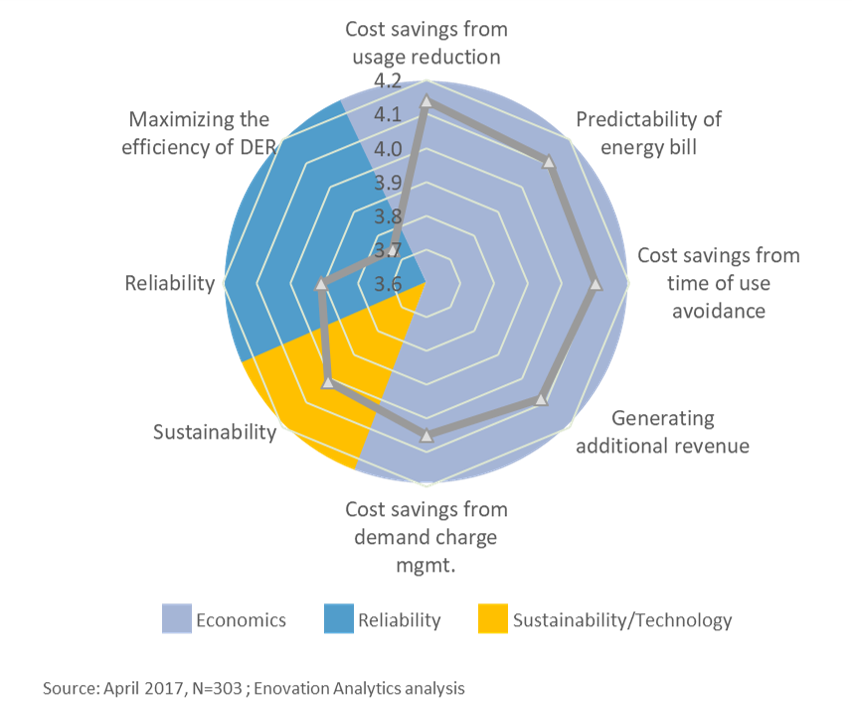

CUSTOMER MOTIVATION FOR CHOOSING BTM STORAGE

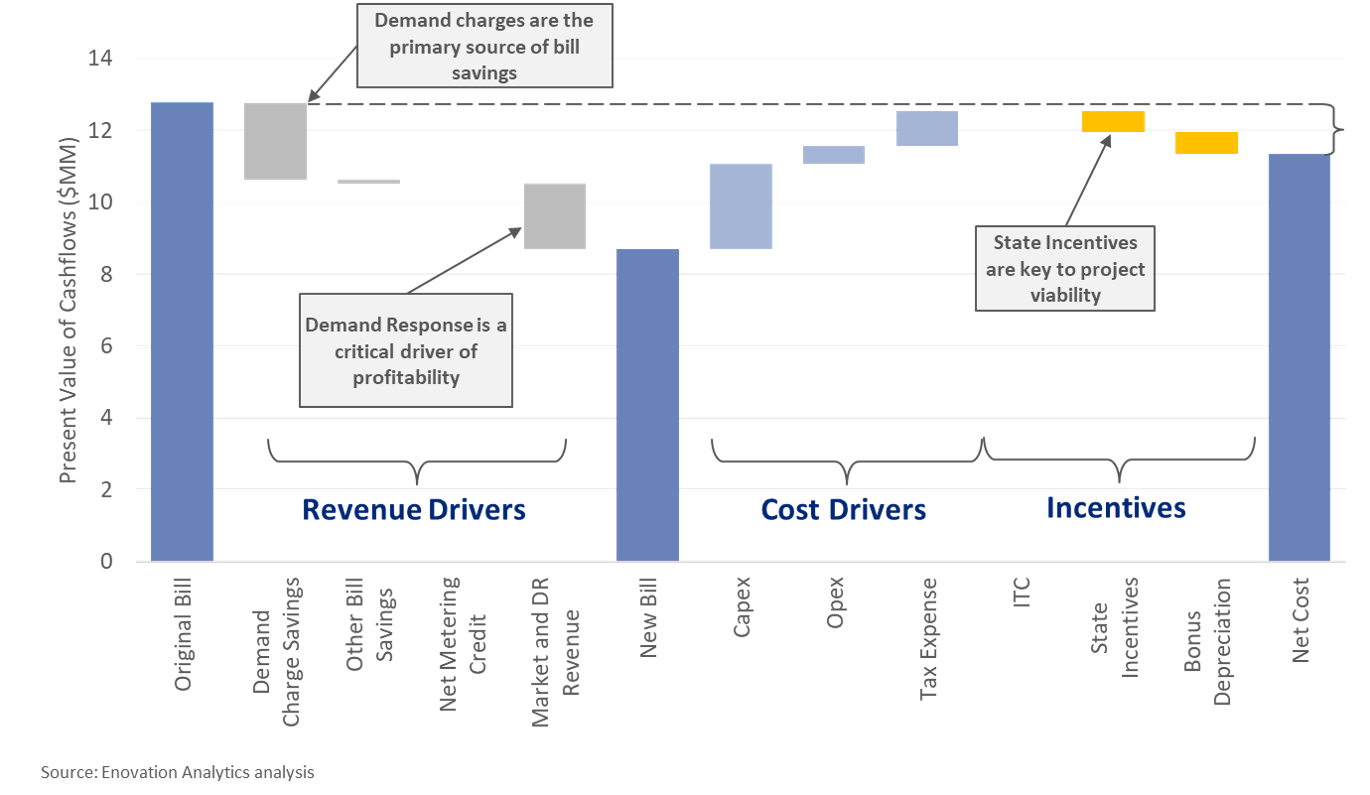

SOUTHERN NY STATE EXAMPLE: LARGE OFFICE PROJECT

Behind-the-meter (BTM) storage investment decisions are easiest when the customer’s returns cannot be ignored. That is, when projects are so “in the money” that buyers are motivated to wade through the education, complexity, and fiscal conservatism that plague investment decisions on traditional “overhead” expenses (i.e. utility bills).

Our primary research on storage buyer motivations corroborates this viewpoint. Our data shows potential customers place significantly higher importance on cost savings, incremental revenue, and predictable utility bills than on all other motivations. Reliability and sustainability consistently rate as important, but is secondary to project returns for C&I customers.

These data points fuel our motivation to fully understand the drivers of economic returns for BTM storage. We’ve investigated these drivers using our DER Economics Tool to evaluate tens of thousands of potential project by varying technologies, configurations, dispatch strategies, customer types, tariffs, and markets across every state / province in North America.

So, you ask, what makes for an attractive market? It’s simple:

- Enabling policies: Accessible programs with rules & requirements favoring storage and/or explicit targets for storage procurement. Mandates for storage in California (1.3 GW by 2020) are already underway, but New York (1.5 GW), Massachusetts’ (1.77 GW), Oregon (1% of peak load), Nevada (1.1 GW), and AZ (3 GW) could soon follow.

- Available incentives: Upfront or performance-based payments to subsidize capital requirements certainly help. Cue New York and California once again where subsidies are available for 30-50% of upfront storage costs.

- High peak or demand charges: Utility bill savings through peak load shifting and/or demand charge management. That’s you, Ontario, where Class A Global Adjustment Charges averaged $450-650/kW-yr. (!) last year.

- Lucrative revenue sources: As always, direct revenue from wholesale or utility markets helps. New York is the prime example, where lucky customers in the right zip codes are eligible for more lucrative tiers of NYISO’s Special Case Resources and Consolidated Edison’s two (!) demand response programs.

How will opportunities for BTM storage evolve? What are your options as a buyer, integrator, developer, or financier? Where should you focus your time? We know markets, value, tariffs, and rules of engagement as well as anyone and can help you explore your options.