Our crystal ball: material displacement of conventional sources by 2028

NORTH AMERICAN ENERGY STORAGE MARKET OUTLOOK

(2018-2027)

Today’s storage market is characterized by declining costs, decreasing risk with each new project, growing regulatory and policy momentum, and niche markets that already make economic sense without subsidies. Indulge us in hyperbole for a moment, but, is energy storage at an inflection point?

Our clients have a vested interest in knowing how, where, and when storage will grow. To support them, we developed a proprietary set of tools to measure the relationship between economic viability, total available market, and rate of adoption. These “S-Curves” tell a fact-based story of adoption – grounded by insights into current project economics.

We’ve applied our tools across markets (20+ US jurisdictions, three European countries, and six Australian states, to name a few), technologies (e.g. Li-Ion, solar PV, reciprocating engines, etc.), and use cases (BTM, IFM, etc.). What have we learned? That the devil is in the details. Creating a forecast is easy; standing on firm ground is the hard part. Our economic analysis tools, deep understanding of underlying cost drivers, and real-world experience navigating regulations and policy set us apart.

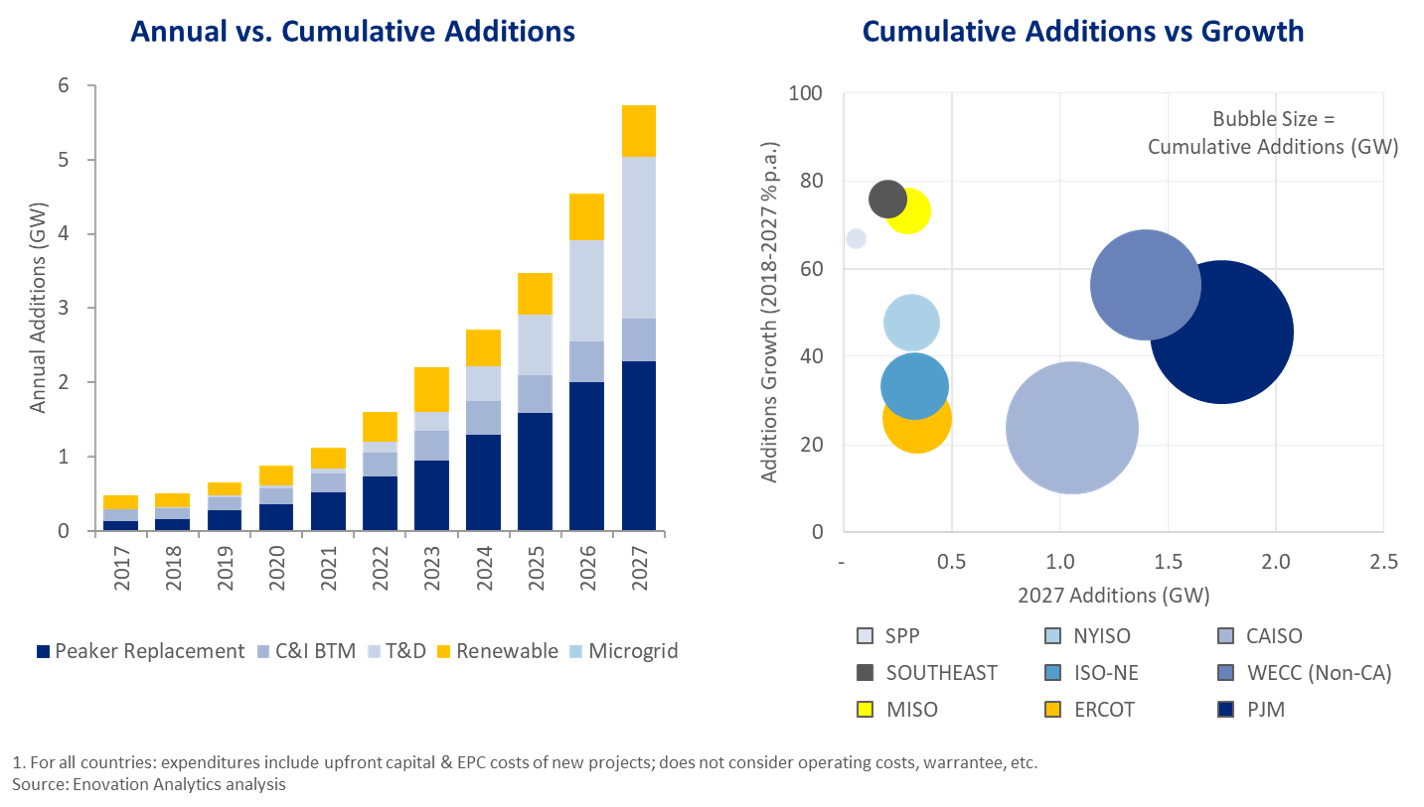

So, to our original question, yes - storage is at an inflection point. In the near-term, we expect storage growth in small “ecosystems” where the underlying conditions (e.g. mandates, IRP procurements, subsidies, value streams) drive favorable returns for investors. However, new technologies (and chemistries) are becoming commercially available each year, value accretive use cases are proven (or disproven) with each new project, price quotes for 2020 are 20% lower than today, and regulatory signs are pointed in the right direction. With these drivers aligning, we see dramatically ramping storage deployment over the next decade.

We work with our clients to understand their forecasting needs and underlying market drivers to shape analyses that fit their business requirements.