How large is the gap between gas-fired generation and storage?

STORAGE VS. CT – CAPACITY REVENUE REQUIREMENT

As previously noted, energy storage’s penetration in Front-of-Meter (IFM) markets has been largely limited to short duration systems providing frequency regulation. This is to be expected as storage outperforms all alternatives in short duration, rapid response applications.

However, the problems with ancillary services are market size and risk of saturation. For example, PJM Reg D – a.k.a. the world’s “most advanced” regulation market – requirements ranged from 250 to 400 MW in 2017. ISO New England’s regulation requirement is only 50 (!) MW. These issues contribute to riskier cash flows, limited upside, and bankability issues for merchant projects.

Energy storage as a “peaker replacement” has long been touted as the holy grail for IFM storage applications. A recent study by the National Renewable Energy Laboratory found a technically addressable market for 4-hr. duration energy storage growing from 3.5 GW today to over 7 GW (~13% of peak load) by 2020 in California alone! For reference, over 145GW of combustion turbines (CT) are in operation in the US as of 2018. Just 1% penetration into this market would roughly triple the currently installed base of electrochemical storage.

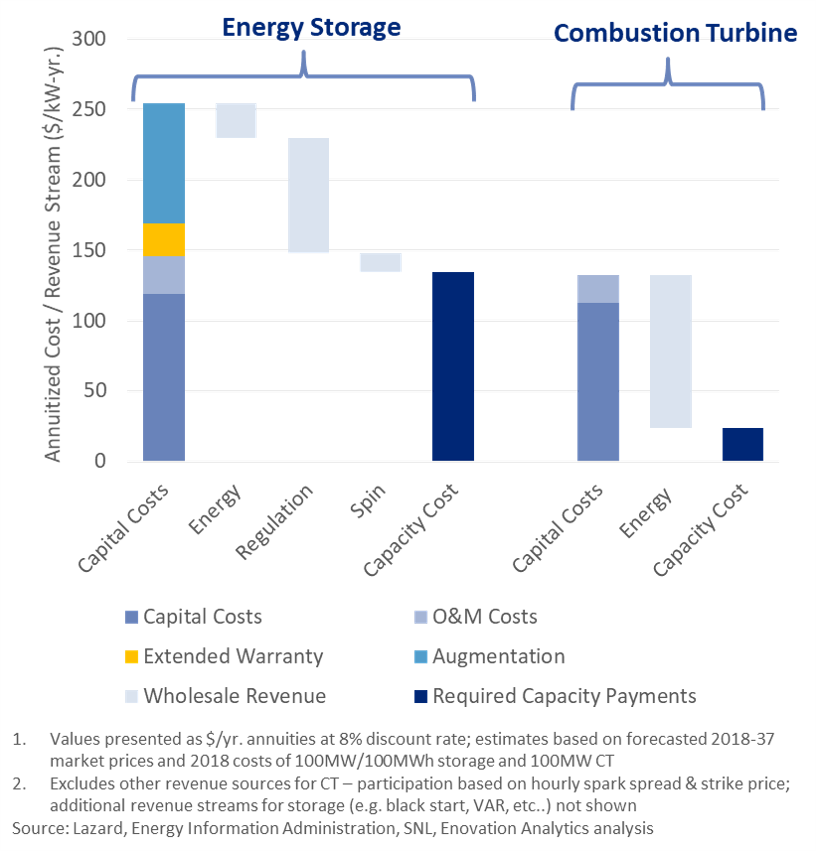

We recently took a different approach and tested storage’s economic viability as a peaker replacement. Our analysis of a Southern California node identified a series of operational, technical, and regulatory characteristics that dictate competitive dynamics between storage and gas-fired generation, including:

- Capital costs of storage are ~2X those of CTs when augmentation costs are fully considered

- Ancillary services revenue for storage is boosted through greater performance and lower marginal costs to participate in reserve markets

- Energy revenue is consistently higher for CTs where dispatch decisions are based on spark spreads. Storage earns energy arbitrage margin, and is constrained by battery size and “competition” for higher value regulation revenue

- Of course, our analysis conveniently ignores the regulatory risks and costs of building gas-fired generation (e.g. see NRG’s Puente project)

Our findings indicate that, absent regulatory hurdles to new gas-fired generation, there is still a way to go before storage can displace peakers on a national scale. However, niche opportunities of collectively significant size exist today for storage as a peaker replacement. Those opportunities expand exponentially with each incremental reduction in storage costs and/or additional revenue stream.

How quickly and where will the market expand? What returns are available to integrators, developers, and asset owners? How might FERC 841 accelerate this market? Our proprietary tools can provide the fact-base you need to support your strategy.