How low can we go?

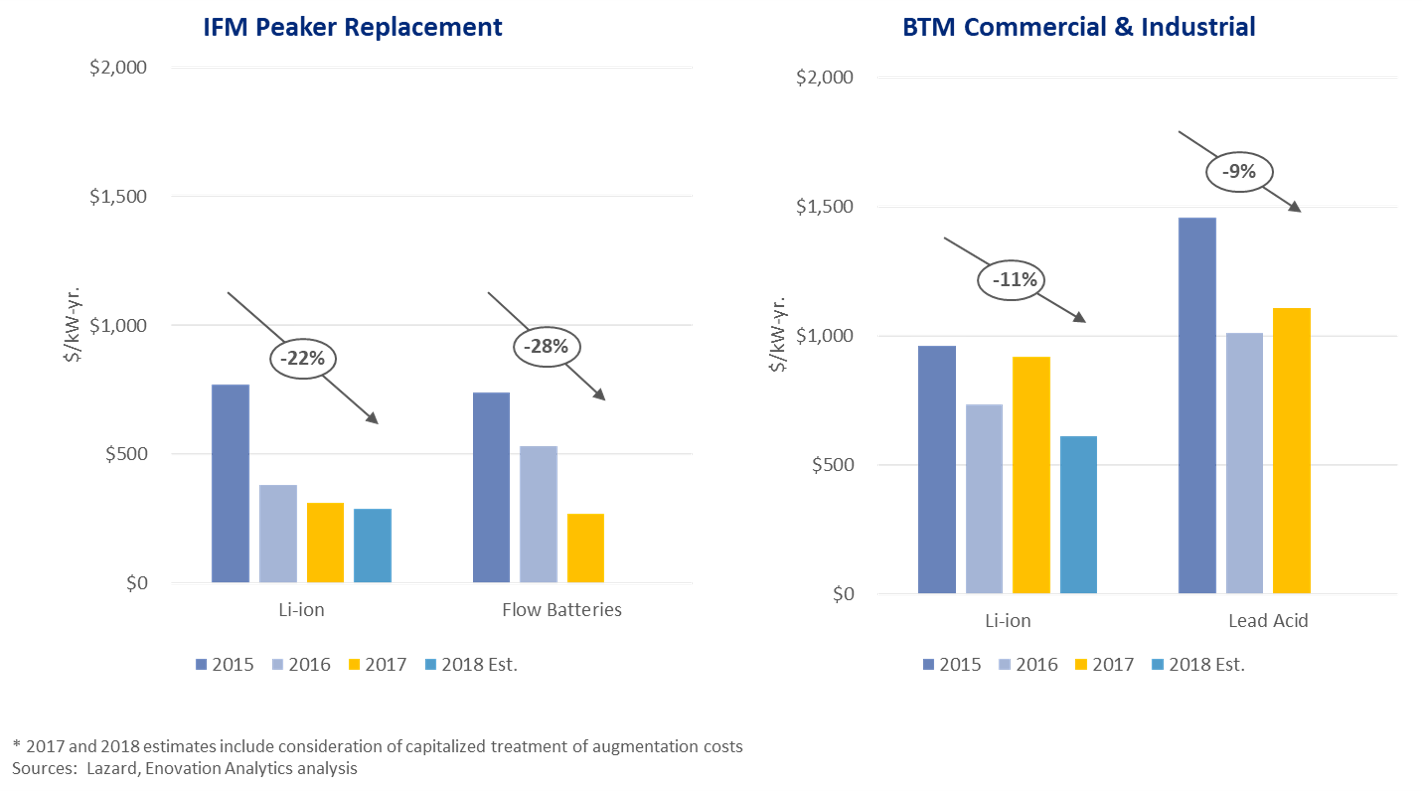

HISTORICAL LEVELIZED COSTS OF STORAGE

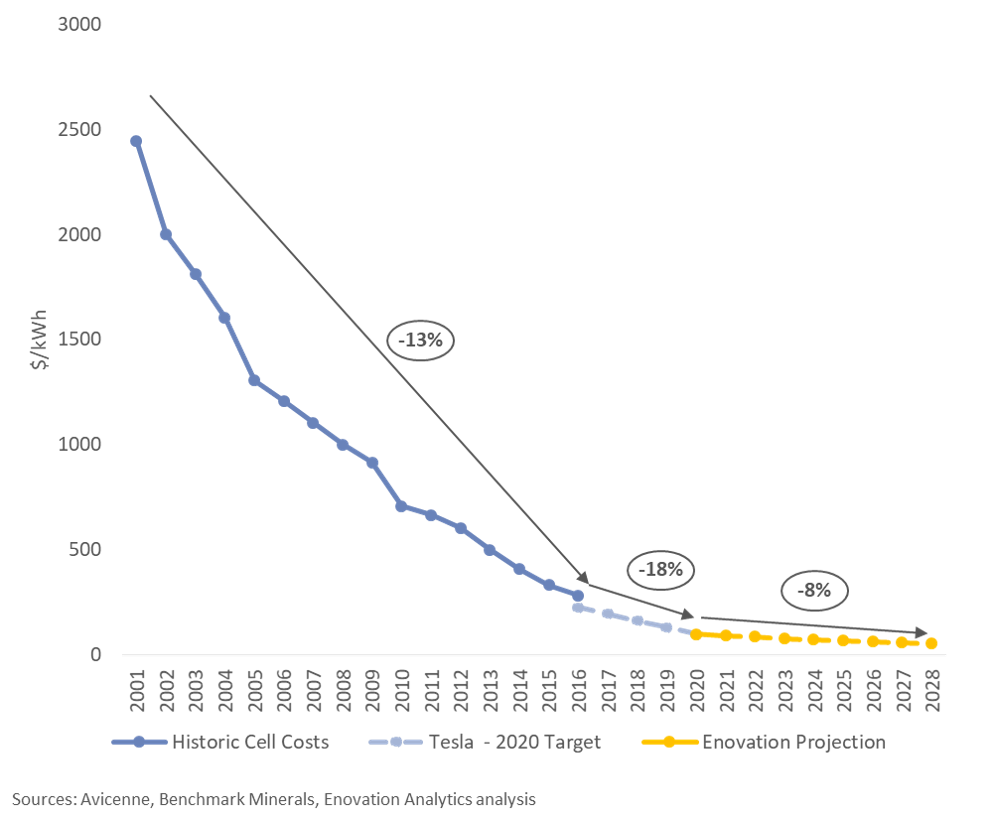

HISTORICAL & PROJECTED LI-ION BATTERY CELL PRODUCTION COSTS

An energy storage optimists’ most cited trend (probably) is cost declines. Our work with Lazard Freres on its Levelized Cost of Storage studies offers confirmation of sustained declines in overnight costs across all use cases and technologies. In three years of collecting and analyzing data, we’ve seen levelized costs of storage fall 25-50%, on average. Recent analyses - including ours - expect average prices of lithium ion battery cells to reach $50-75/kWh by 2025.

The current market, however, has seen "supply chain pain" lead to short-run pricing premiums. We're hearing integrators and battery OEMs are including 15-25% premiums with five-to-six month lead times this quarter.

A few trends have contributed to recent price spikes:

- Demand for Electric Vehicles: Utility and C&I applications for storage account for less than five percent of global lithium ion battery production, and, consequently, must weather demand shocks from other markets. Recent large orders from several European electric vehicle manufacturers have caused material short-term supply diversion.

- Cost of raw materials: Lithium prices have increased 81% since Q1 2017. Cobalt increased 115% over the same period. Resulting cost increases have been partially passed through to customers while leading OEMs explore new lithium chemistries to reduce dependency on scarce materials.

- Scrutiny on insurance and performance: Customers are seeking greater assurance of asset performance on recent projects, resulting in changing system configurations. Want a 10-yr. warranty? Then you might have to stomach a 30% over-sizing of the battery.

Incumbent battery producers have bought into the optimism by leading a massive expansion in global capacity. In 2016, global lithium ion cell demand of ~90 GWh strained producer manufacturing capacity to over 85% utilization. Since then, over 200 GWh of additional capacity has been announced or is under construction. Tesla’s Gigafactory is leading the way with 35 GWh / yr. projected throughput, but nearly all incumbent battery producers (e.g. Samsung SDI, CATL, LG Chem, etc.) are planning new expansion.

Continued technology advancement will be another major driver of cost declines. Increasing lithium ion battery voltage limits and high capacity cathodes will, by definition, drive continued performance improvements. Commercialization of new chemistries (e.g. Li-Air, Li-S, LTO) promise further performance improvement at reduced materials costs. Long-term, Lithium Manganese and other early stage chemistries show promise for massive improvements to battery stability and lifetimes.

When will pricing stabilize? How far will prices fall? Which storage applications, market participants, and regions will benefit most? Our strategic advisory experts can help assess the impact to your business.