The end of rapid distributed PV growth?

After a decade of double-digit growth and with over 2 GW expected to be installed in 2018, residential PV has become a major force in the energy industry. However, cost declines are leveling off, net metering remains under duress, and the ITC will soon be no more. So, when will residential PV’s hangover set in?

Historical growth of customer sited PV was driven by declining costs, retail net energy metering (NEM), and incentives. A large portion of those cost declines were realized through the reductions in module cost. Recently, module prices have leveled off and even increased this year due to tariffs on Chinese manufacturing. Developer focus has turned to reducing soft costs and the balance of the PV system, but these have proven far more stubborn than expected. On the policy side, ITC is scheduled to phase out over the next 4 years with no prospect for extension. Finally, across the country NEM policies are become less generous, either with reduced export rates, punitive derating of ‘roll over’ credits, or high fixed charges. These changes all point to the end of an era.

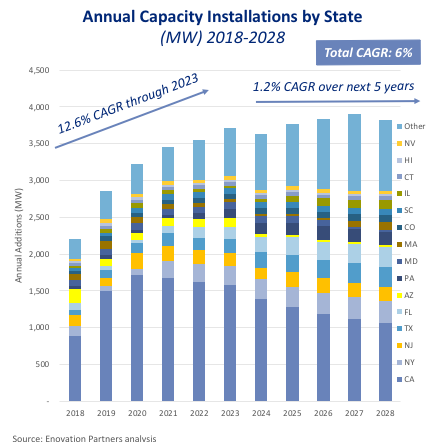

Yet our outlook for residential solar remains bullish. Our Zip code level economic model tells us to expect a few more years of rapid growth for the customer sited market. The industry is still maturing, with price focused competition still the standard. This will drive additional reductions in soft costs, as will the (eventual) removal of tariffs. These factors, combined with standard rate increases, will continue to improve economics as long as utilities remain reluctant to move to large fixed charges. Furthermore, we expect a perpetual rush to get the best possible ITC will drive the market even higher.

In the outyears, changes to rates and NEM and the death of the ITC will eventually take their toll on PV adoption. After several years of boom, the growth engine that was California’s residential market will finally start to slow as adoption surpasses 30% of feasible residential roofs and the new build market takes the reigns.

How can solar companies prepare for this new world? Who will benefit most? Could storage become a meaningful addition to the market? And how will this impact states RPS goals?